California Paycheck Calculator

Breakdown of California Fees

Ca has got the highest top marginal tax price in the nation. It’s a high-tax state in basic, which impacts the paychecks Californians make. The Golden State’s tax system is modern, this means rich filers spend a greater marginal income tax price to their earnings. Cities in Ca levy their particular product sales fees, but don’t charge their particular income that is local.

You cannot withhold significantly more than your investment returns. Please adjust your .

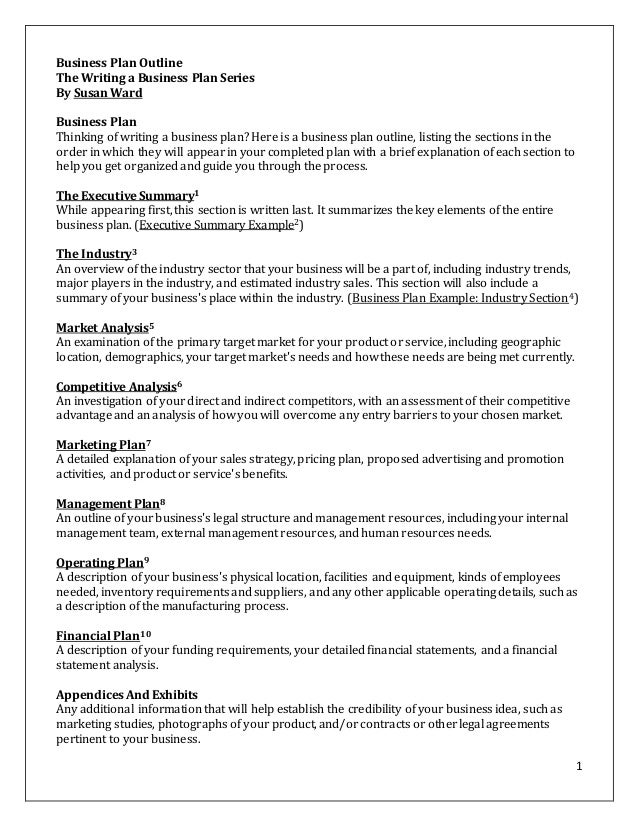

| Gross Paycheck | $ — | ||

| Taxes | — % | $ — | |

| Details | |||

| Federal Income | — percent | $ — | |

| State Income | — percent | $ — | |

| Local Income | — percent | $ — | |

| FICA and State Insurance Taxes | — percent | $ — | |

| Details | |||

| personal safety | — percent | $ — | |

| Medicare | — percent | $ — | |

| State Disability Insurance Tax | — % | $ — | |

| State Unemployment Insurance Tax | — percent | $ — | |

| State Family keep Insurance Tax | — percent | $ — | |

| State Workers Compensation Insurance Tax | — percent | $ — | |

| Pre-Tax Deductions | — percent | $ — | |

| Details | |||

| Post-Tax Deductions | — percent | $ — | |

| Details | |||

| get hold of Salary | — per cent | $ — | |

Jennifer Mansfield, CPA, JD/LLM-Tax, is an avowed Public Accountant with over three decades of expertise tax advice that is providing. Jennifer has mostly worked in public areas accounting organizations, including Ernst & Young and Deloitte. Read more